Driving Growth with ERP Expertise - Unlocking Efficiency and Compliance: A Comprehensive Guide to MyInvois E-Invoicing in Malaysia

Discover the transformative power of e-invoicing in Malaysia with MyInvois. Streamline your processes, ensure compliance, and unlock efficiency

Introduction to MyInvois E-Invoicing

Electronic invoicing, often abbreviated as e-invoicing, is the process of creating, sending, receiving, and processing invoices electronically, rather than using traditional paper-based methods. E-invoicing utilizes digital formats and standardized communication protocols to exchange invoice data between businesses or between businesses and governmental entities.

An e-Invoice is a digital representation of a transaction between a supplier and a buyer

Understanding E-Invoicing and Its Benefits

Unified invoicing process: Businesses can streamline creating a document and submitting it. Further, they can automate the data entry process.

Integrated tax return filing system: Seamless integration helps in efficient and accurate reporting of tax returns.

Streamlined operations: Improved efficiency and significant resources saved for businesses.

Improved cash flow: E-invoicing significantly reduces calculation and billing errors. This move results in faster payment cycles and reduced disputes.

Digitized financial reporting: e-Invoice aligns financial reporting and processes to be digitalized with the industry standard.

How MyInvois Works: A Step-by-Step Guide

E-invoice Model

MyInvois Portal hosted by IRBM: The MyInvois Portal can be accessed by all businesses. However, this portal is only suitable for a small volume of data and is feasible for Micro, Small, and Medium-sized Enterprises (MSMEs).

Application Programming Interface (API): API in either XML or JSON format. Adoption of API requires an investment in technology and modifications to the current systems. However, this is the ideal e-invoice generation mode for large businesses with a huge volume of transactions.

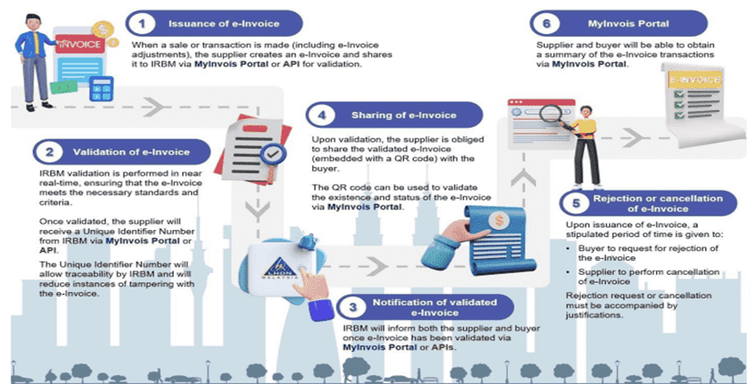

E-invoice Workflow

E-invoice Transaction

e-Invoice covers transactions such as:

- Business to Business (B2B),

- Business to Customer (B2C), and

- Business to Government (B2G). It is to be noted that e-invoice flow for B2G transactions will be similar to B2B.

e-Invoice applies to all commercial activities in Malaysia, including the sale of goods and services and specified non-business transactions between individuals.

In the case of B2C transactions, sellers do not have to issue e-invoices to the end consumers; however, they shall issue a normal invoice or receipt. After a specified timeline, the seller should aggregate all the normal invoices or receipts and issue a consolidated e-invoice

E-invoice Types

• Invoices: It is generally used to record transactions between supplier and buyer. Invoice also include a self-billed invoice issued for tracking expenses.

• Credit notes: A credit note is a document issued by sellers to make corrections to an e-Invoice issued previously mainly to lower the original invoice's value without returning money to the Buyer. It is generally used to adjust errors, apply discounts, or account for returned items.

• Debit notes: In contrast to credit notes, debit notes are issued to record additional costs related to a previously issued e-Invoice.

• Refund notes: A refund e-Invoice is an official document issued by a Seller to record refund issued to the Buyer.

• Self-Billed Invoice Self-Billed Invoice refers to the initial self-billed e-Invoice that will be issued by the Buyer

• Self-Billed Credit Note: Self-Billed Credit Note is issued by Buyers to correct errors, apply discounts, or account for returns in a previously issued Self-Billed e-Invoice with the purpose of reducing the value of the original Self-Billed e-Invoice. This is used in situations where the reduction of the original Self-Billed e-Invoice does not involve return of monies to the Buyer

Self-Billed Debit Note : Self-Billed Debit Note is the document issued by Buyers to indicate additional charges on a previously issued Self-Billed e-Invoice

• Self-Billed Refund Note: Self-Billed Refund Note is the document issued by Buyers to confirm the refund of the Buyer's payment. This is used in situations where there is a return of monies to the Buyer

E-invoice TimeLine

| Phase | Annual Turnover | Budget 2024 announcement |

| 1 | > RM 100 million | 1 August 2024 |

| 2 | > RM 25 million and up to RM 100 million | 1 January 2025 |

| 3 | All taxpayers | 1 July 2025 |

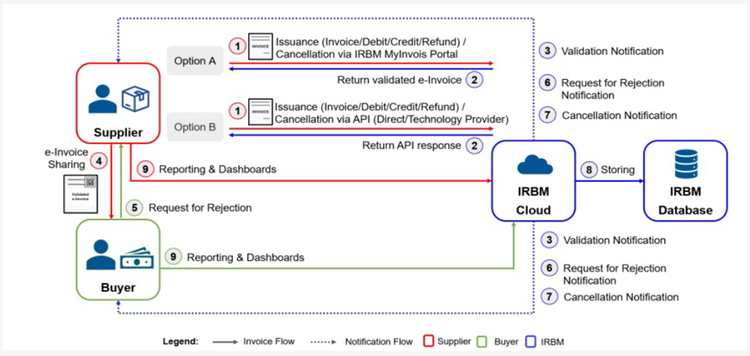

E-invoice API’s Flow

Pranjul Varshney

Pranjul Varshney is a seasoned professional with over 15 years of extensive experience in the realm of enterprise resource planning (ERP), specializing in SAP Business One, Idempiere, and ERPNext. With a profound understanding of these platforms, Pranjul has established himself as a proficient consultant and project manager, adept at delivering tailored solutions to diverse business needs. Pranjul's journey in the field of ERP began with SAP Business One, where he honed his skills in implementing and customizing solutions for small and medium-sized enterprises (SMEs). His meticulous approach and in-depth knowledge have enabled him to navigate the complexities of SAP B1 projects, ensuring seamless integration and optimization of business processes. Expanding his expertise, Pranjul ventured into open-source ERP solutions, including Idempiere and ERPNext. Embracing the flexibility and innovation offered by these platforms, he has successfully led numerous implementations, leveraging their robust features to empower organizations with scalable and cost-effective ERP solutions. As a seasoned project manager, Pranjul possesses a proven track record of steering projects from inception to fruition. His strong leadership, strategic vision, and effective communication skills enable him to collaborate seamlessly with cross-functional teams, driving projects to meet objectives within scope, budget, and timeline constraints. Beyond his technical proficiency, Pranjul is passionate about driving digital transformation initiatives and leveraging ERP systems as catalysts for organizational growth. He thrives on challenges, continuously seeking new opportunities to enhance operational efficiency, optimize workflows, and deliver tangible value to clients. With a steadfast commitment to excellence and a passion for innovation, Pranjul Varshney stands as a trusted advisor and expert in the field of ERP, dedicated to empowering businesses to thrive in the digital age.

No comments yet. Login to start a new discussion Start a new discussion